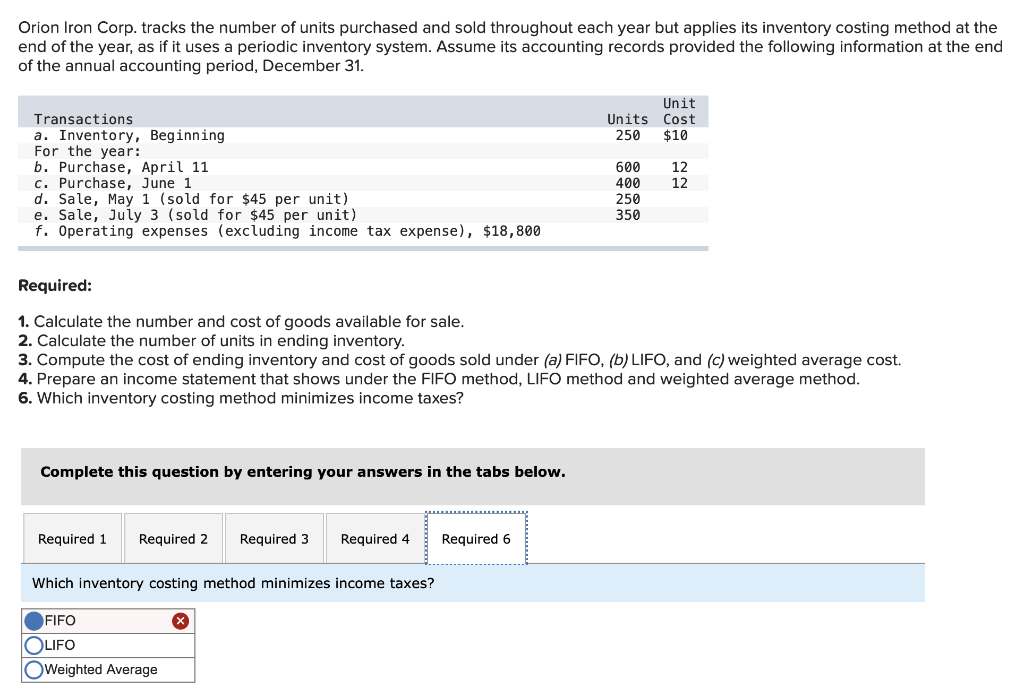

Sales Revenue OOO 680700. Up to 256 cash back Calculate both Cost of good sold and Ending Inventory using Periodic LIFO Method.

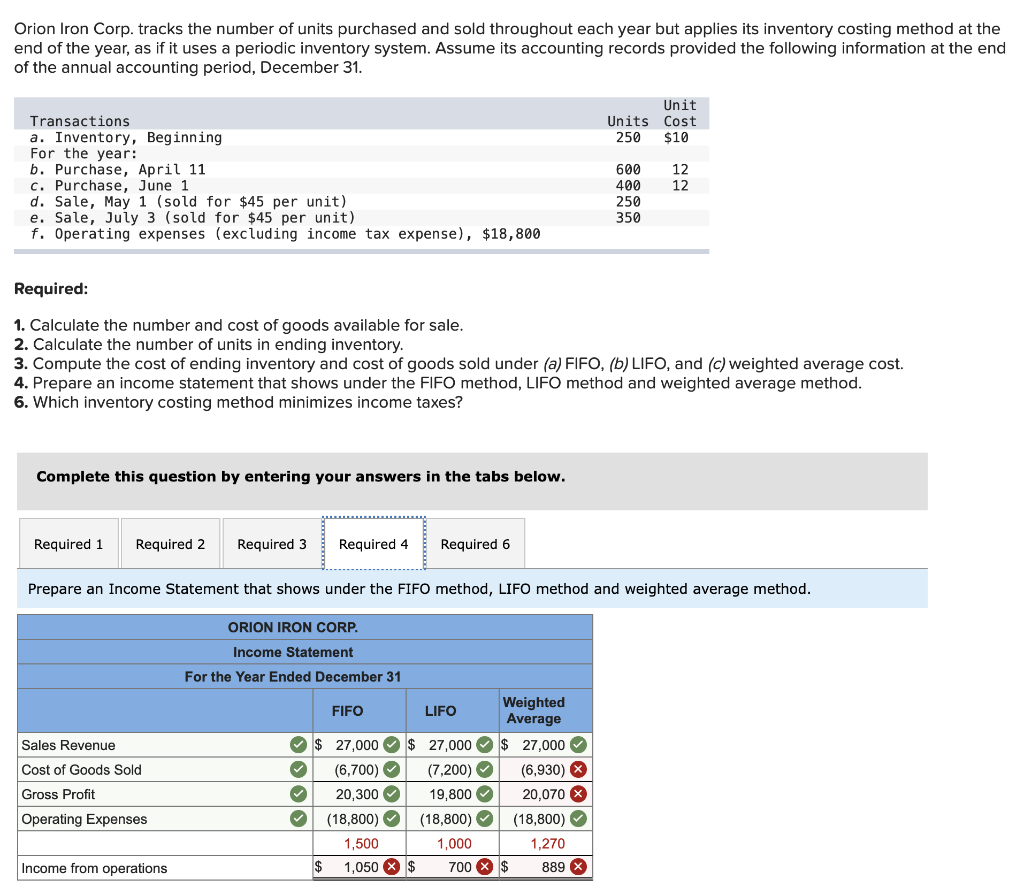

Solved Orion Iron Corp Tracks The Number Of Units Purchased Chegg Com

Ad Supply Chain Management Software SCM Software by Logility.

. Calculate the number and cost of goods available for sale. Contact us schedule a demo. The first-in first-out FIFO inventory cost method can be used to minimize taxes during periods of rising prices since the higher inventory prices work to increase a companys.

Operating expenses excluding income tax expense 612000 29 31 10 eee 6000 4500 9000 Required. Select the whether the FIFO or LIFO inventory costing method normally produces each of the following effects under the listed circumstances. Use method to attract investors or borrow money.

Ad Supply Chain Management Software SCM Software by Logility. Use your calculations from 1-2 and complete the Income Statement. Calculate the number and cost of goods avalable for sale.

In a declining price scenario the oldest inventory items have the highest costs and create the largest cost of goods sold and lowest taxable income. If your aim is to reduce your tax bill you. LIFO minimizes net income and income taxes and.

The company began the year with a zero inventory balance. Improve profitability free up working capital. Operating expenses excluding income tax expense 612000 10000 6000 4500 9000 29 31 Required.

Inventory planning by Logililty. Which inventory costing method minimizes income taxes. The first-in first-out FIFO inventory cost method assumes the oldest inventory is sold first.

A company uses the weightedaverage method of inventory valuation under a periodic inventory system. The methods from which to choose are varied generally consisting of one of the following. Cost of ending inventory.

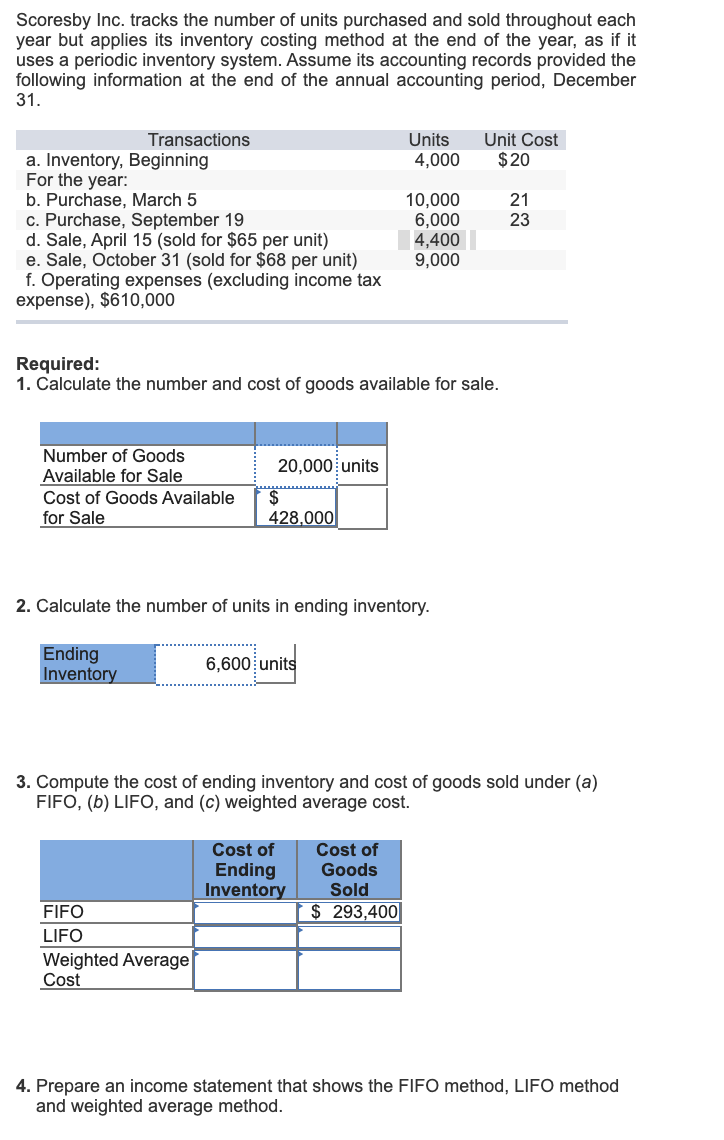

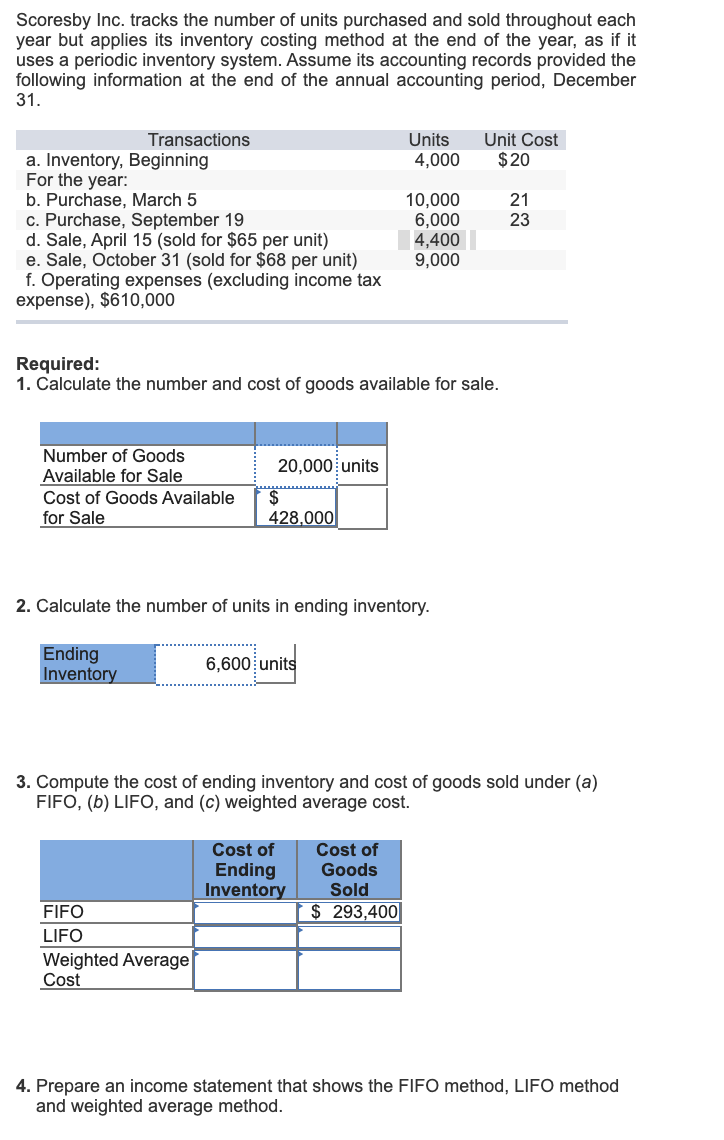

Inventory planning by Logililty. Scoresby Incorporated tracks the number of units purchased and sold throughout each year but applies its inventory costing method at the end. Cost of goods sold.

Start studying Inventory costing methods. Contact us schedule a demo. This leads to minimizing taxes if the prices of inventory items are falling.

Most closely matches actual flow of goods in most cases. X Answer is not complete. Minimize future write-downs on inventory.

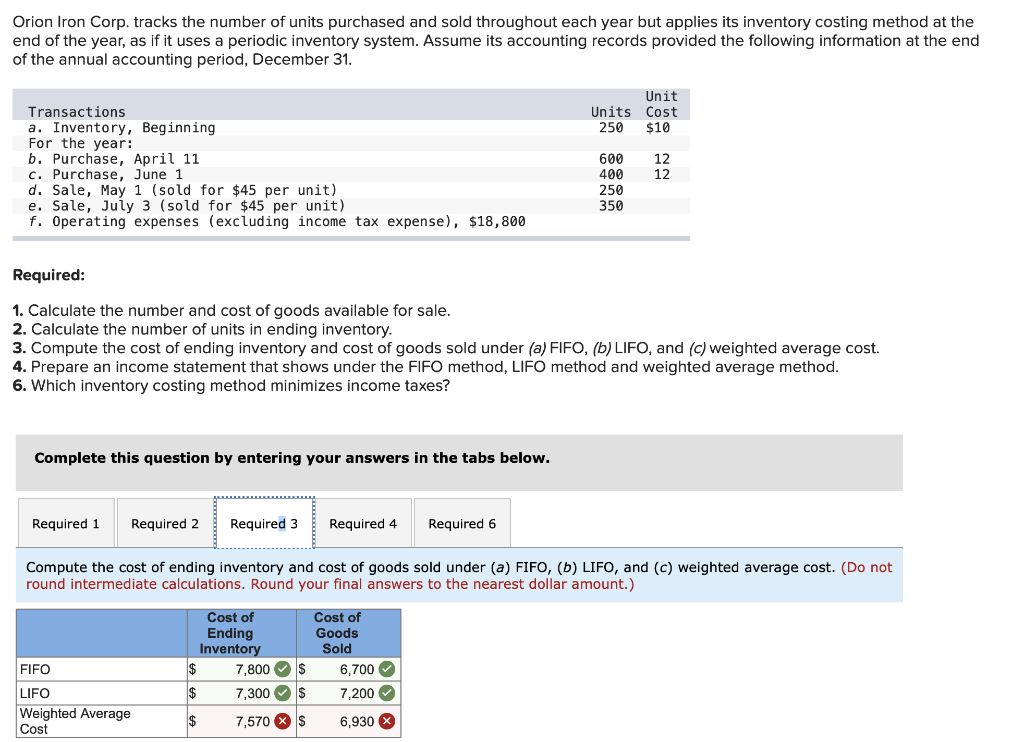

Learn vocabulary terms and more with flashcards games and other study tools. Calculate the number of units in ending inventory. Compute the cost of ending inventory and cost of goods sold under a FIFO bLIFO and c weighted average cost.

First-in first-out FIFO Last-in first-out LIFO Weighted-average. Complete this question by entering your answers in the tabs below. Each of these methods entails.

Improve profitability free up working capital. Inventory Beginning 1500 Question.

Solved Orion Iron Corp Tracks The Number Of Units Purchased Chegg Com

Solved Orion Iron Corp Tracks The Number Of Units Purchased Chegg Com

Solved Scoresby Inc Tracks The Number Of Units Purchased Chegg Com

Solved Orion Iron Corp Tracks The Number Of Units Purchased Chegg Com

0 Comments